After the Q2 Newsletter, I answered a good number of general questions on investing and retirement planning. Therefore, I've decided briefly discuss some basic investment guidance for the "average" investor (or novice investor). Are you a novice investor? Probably. Here is a quick test. Do you know:

- What it means when someone refers to the market capitalization of a stock?

- The difference between a mutual fund and an exchange traded fund?

- A good price to free cash flow rate?

- How share repurchases effect the price to earnings ratio?

If you don't know the answers to the majority of those questions it is safe to say that you are a novice investor (which isn't bad or uncommon). It's estimated that a large majority of all investors fall into this category.

So, assuming you are a non-expert investor, what are some simple guidelines to follow to help you achieve future goals? I'll suggest a few:

- Save

- Think Long-Term

- Diversify

- Minimize fees

- Understand natural human behavior

Save

This is very simple concept. If you are looking to build wealth to achieve future goals you have to spend less than you make. If you're investing for retirement, most experts recommend saving between 10% and 15% of your salary. If you currently save much less than 10% of your salary, try small increases over many years to get to 15% or more. This principle called "save more tomorrow" has been shown by behavioral economists to increase savings rates significantly over time by reducing drastic lifestyle changes that come with a significant change in savings rates. Here is a quick example: say you currently save 6% of your salary and you get a 2% raise each year. When you get your next raise, increase your savings rate to 7%, do the same the next year and the year after that. In nine years, you will have increased you savings rate to 15% without changing your lifestyle significantly. Additional reading on the save more tomorrow study is available here.

Think Long-term

In 1973, a US postage stamp cost 8 cents, but in 2012 a stamp cost 45 cents (and in 2015 a stamp costs 49 cents). This means that if you had $100 in 1973 you could have purchased 1,250 stamps. Yet in 2012, $100 only purchases 222 stamps (your purchasing power declined by over 5.5 times in the 39 years). This is important because it illustrates just how costly it can be to not to invest. If you invested that $100 in a 60/40 combo of stocks and bonds in 1973, it would have been worth $3,773 in 2012... and would allow you to buy 8,384 stamps (increased purchasing power of more than 6 times what it was in 1973). While sticking $100 under your mattress, would obviously leave you with $100 today. What seems "safe" in the short-term is extremely costly in the long-term. Focusing on the long-term allows you to increase your purchasing power over time.

Diversify

The trade-off for the greater return provided by investing in stocks is volatility. Your investment could be worth $100 one day, $102 another and $93 a month later. Owning stocks is equivalent to owning a piece of a company, and some companies will fail. This is why the average investor should diversify, owning one company or one asset creates unnecessary risk. My recommendation for the average investor is simple: own multiple assets types. Start with stocks and bonds.

The appropriate percentage of each is less important than you may think. Back-testing of nine different (frequently recommended) asset allocation strategies shows similar returns over 39 years (1973 - 2012). Additional details here.

Source: Meb Faber, CAGR stands for compound annual growth rate, MaxDD is maximum draw down

If you're thinking this seems too complicated, you are in luck. There are excellent investment options for you, with solid well researched and back-tested strategies that you can purchase for very reasonable fees. Investing in or working with one of the providers below we almost certainly outperform 90% of your peers over long periods of time (10+ years). Recommendations include:

- Wealthfront - automated investment service with low fees. Well researched asset allocation models based on your risk appetite.

- Betterment - a Wealthfront competitor with a similar strategy, low fees and solid asset allocation strategies.

- Vanguard Target Funds - Low fees, asset allocation adjusts with age, ideals funds for 90% of the population.

Minimize Fees

This is also very simple, but might be the most important thing with which the average investor should be concerned:

- $100k investment in a mutual funds with a 0.25% annual fee (assumes annual return of 6%), turns into $532,899 after 30 years.

- $100k investment in a mutual funds with a 0.90% annual fee (assumes annual return of 6%), turns into $438,976 after 30 years

Source: Vanguard

If you minimize fees, you make $93,923 more money with no additional work. The best way to do this is to buy funds from Vanguard, because Vanguard has a unique ownership structure - "The company's profits are used to return dividends to its investors and to lower management fees." Vanguard funds almost always have the lowest fees available in the market.

Understand human behavior

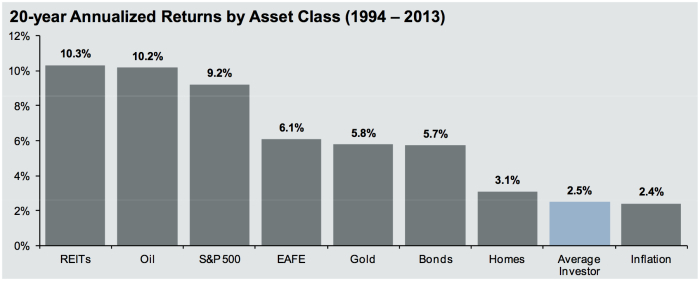

Tests show that it is twice as painful to lose a dollar as it is joyful to gain a dollar. When the a new pair of Nikes are on sale for 40% off, you are much more likely to buy them (or at least I am). Yet, when your investments drop by 40% many people sell. The average investor return from 1994 to 2013 was 2.5%. This is because too many investors sell when their investments drop in value and buy investments near their peak (sell low / big high).

Source: JP Morgan Guide to the Markets Q4 2014 using DALBAR data ending in December 2013.

An investor return of 2.5% is much worse than it should be, but not necessarily surprising. Our brains are wired for hunting and gathering, rather than investing in stocks. There an easy way to improve your investing behavior, by rebalancing your investments. The automatic portfolios suggested above correct for your human investing weakness by rebalancing annually. You should too. Rebalancing simply forces you to buy stocks or bonds when the prices have gone down (and they are a deal). Example: If you started the year with a 50/50 mix of stocks and bonds and stocks performed poorly at year end you might have a 45/55 mix of stocks and bonds. At the beginning of the year you would sell some bonds and buy some stocks to get back to a 50/50 mix. This forces to to buy more of the undervalued asset and significantly improves returns overtime.

Valuation metrics and under-priced stocks

US EQUITY VALUATION

Shiller P/E (CAPE Ratio) | As of 012/12/2015

Mean: 16.63, Median: 16.01, Min: 4.78 (Dec 1920), Max: 44.19 (Dec 1999), Implied future annual return (over 8 years) = 2.9% to -3.2%

Notes on valuation: I look at valuation metrics (like the CAPE ratio shown on the above) to provide some context of how expensive stocks are compared to historical levels. Currently, valuations are above average.

US STOCKS FOR THE DEFENSIVE INVESTOR

Inspired by Benjamin Graham | As of 12/12/2015

Defensive Investor Notes: My personal favorite investment strategy uses Benjamin Graham’s (Warren Buffett’s mentor and professor at Columbia Business School) guidance to identify companies, with a strong cash position, low debt, and stable dividends paid over many years that are trading at bargain prices. Similar techniques have yielded annual returns of approximately 18% since 2001.

WORLD’S CHEAPEST STOCK MARKETS

Five cheapest stock markets | As of 10/30/2015

Source: Star Capital

Not surprisingly, the world’s cheapest stock markets are often “cheap” for a reason (this approach isn’t for everyone). Countries like Russia have significant challenges, but often represent extraordinary value. For that reason, diversification is critical for long-term success.

Notes on the world's cheapest stock markets: Investing strategies that buy the world’s most affordable stock markets have proven to be very successful in the past (averaging an annual return of approximately 16% from 1980-2013). For that reason, I keep a close eye on investing opportunities overseas.