Value and factor investing from AQR

https://www.aqr.com/Insights/Perspectives/A-Gut-Punch

Value and factor investing from AQR

https://www.aqr.com/Insights/Perspectives/A-Gut-Punch

Note: I may have the ability to take on private wealth management clients in 2021 (fixed fee, 6K per year). Join the waitlist by emailing mccauleycapital@outlook.com.

So much of the investing advice you have heard over the years relates to creating an investing process that helps you overcome the natural pitfalls of human behavior. If an investment professional is telling you:

“to invest in index funds,” they might mean “most people are terrible at picking stocks, your investment returns will improve if you don’t pick individual stocks”

“to dollar-cost average into the market,” they might mean “make your investments free of emotions”

“automate your savings” might mean “humans often spend whatever cash is available to them (and sometimes more) if you don’t set money aside before you have a chance to spend it you won’t end up saving money at all”

This happens throughout life, people aren’t often as direct or articulate as might be ideal. However, when enough of this “translation” becomes commonplace the true messaging can get lost. In 2020, one key (often overlooked) principle drove returns - staying invested in times of uncertainty, turbulence, and even high-valuations. This extraordinary year was unique from an investing perspective, throughout the year one could have easily argued that the right thing to do was to sell stocks and move into “safer” positions, cash, bonds, gold, or Bitcoin (that’s a joke :)). The stock market started 2020 with high valuations relative to market history (more on this shortly). In March, the stock “fell off a cliff” without fears about the pandemic (and its potential impact on the economy). Yet, when we zoom out and look at market performance for the year. The S&P500 is up 13% (light green), NASDAQ up 40% (yellow) and the Dow is up 4% (blue).

And thus, in a year where there were all sorts of reasons to move away from equity investments… the stock market (I’ll focus on the S&P 500 from this point forward), did what it does most commonly - it returned somewhere between 10-20% annually (returns by year are shown below). Most experienced investors have learned this point over the years, there are several compiling reasons to sell your investments in any given year, but when you stay invested you will be rewarded handsomely.

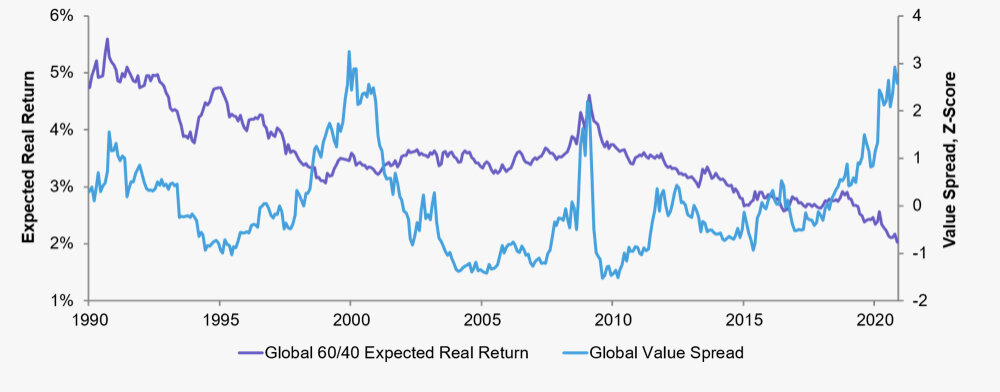

Inquisitive minds will immediately understand the point above and jump to a more interesting question - “surely you aren’t telling to stay invested at these insane valuations, are you?” Well, it depends on your situation (many people with long time horizons and sounds strategy should stay the course), but I’m not saying you should completely disregard valuations either. As a value investor, I believe in buying undervalued assets and it’s hard to argue that US equities are undervalued at the moment.

Analysis from the Leuthold Group. Valuations from Feb 2000 vs. Nov 2020.

All the valuation factors “of the median stock in the S&P” are currently greater than they were at the peak of 2000. So, it’s easy to argue that current valuations aren’t sustainable and mean revision is coming, but that doesn’t mean that you should move to cash. High valuations in the US mean you should consider investing more of your capital in international markets, or focus more on a value strategy in the US (recommended reading here - Global Value: How to Spot Bubbles, Avoid Market Crashes, and Earn Big Returns in the Stock Market). Staying invested has rewarded investors in the past, and the future will be no different. Don’t let the true message get lost in translation, the bad habits created by trying to predict future returns will do more damage over the long-term than any possible savings they can provide in the short-term.

I can’t find the video of this, so you will have to trust my memory. Howard Marks is on CNBC and his segment follows some yahoo with a terrible business… as a transition between segments, the host asks Mr. Marks if he would ever invest in the “yahoo’s” business. And Mr. Marks says “for a price.”

Those three words are brilliant. The price you pay is what determines investment success. It’s reasonable to pay more for a great business with a sustainable competitive advantage then you would be to buy a dying business (no one argues that). But buying a great business at an expensive price is often a worse investment than buying a challenged business at a fantastic discount to its true (intrinsic) value. Vitaliy Katsnelson (@vitaliyk) clearly articulates the concept in the following tweets:

If you bought Disney in 1999 - which was a great company then - it would take 12 years to break even. $DIS another lesson -- > great company doesn't always equal great stock.https://t.co/z8IeIaBFfE pic.twitter.com/KyStvhja45

— Vitaliy Katsenelson (@vitaliyk) June 22, 2020

Cisco Systems - great company in 1999, still great company today. Folks who bought it in 1999 still waiting to break even.

— Vitaliy Katsenelson (@vitaliyk) June 10, 2020

Can you pay too much for a great company? Yes! pic.twitter.com/fqEC504Cov

Back to Howard Marks. Anytime you can spend reading Howard Marks is time well spent (I highly recommend his book “The Most Important Thing”). The following quotes help explain his “for a price” comment.

First-level things says, ‘It’s a good company; let’s buy the stock.’ Second-level thinking says ‘It’s a good company, but everyone thinks it’s a great company, and it’s not. So the stock’s overrated and overpriced, let’s sell.

First-level thinking says, ‘The outlook calls for low growth and rising inflation. Let’s dump our stocks.’ Second-level thinking says, ‘The outlook stinks, but everyone else is selling in a panic. Buy!’

Betting on the fastest horse rarely gives you the best odds of winning money, instead, you should bet on the horse whose odds are most undervalued (of course, you invest rather than waste money betting, right?). As an aside - In Colorado, where I live, sports betting was just legalized. If you want to better understand the difference between speculation and investing, bet on a few games. If you manage to stay rational, you will quickly see that betting requires too much luck to be a good investment (for the large majority of people). True investing, with a long-term strategy and clear process, has significantly better odds of success.

Yes, my wife loves “period pieces” ;)

I didn’t write a newsletter during the market downturn in March when the market was extremely volatile, but I did field calls and emails from 20ish friends, colleagues, and family members. Many people I talked to were concerned, and second-guessing their long-term investing strategies - some were looking for reasons to overreact. Overreacting and adjusting your investment strategies is the easy thing to do, the human brain is wired to react in a way the “protects” us, going back to our hunter and gatherer days. I only write this newsletter twice a year (instead of quarterly or weekly) because I find that (often) the more you talk/read/discuss the more you overreact. Looking back, the March drama looks like nothing but an emotional roller coaster.

Let’s look at a few simple examples with where real money was invested in balanced funds (US/International stocks, Muni bonds). The blue line is the invested amount and the green line is the account value. The accounts are roughly 80/20 stocks vs. bonds. The first example has a constant investment balance (i.e. you put 10k in the account 2 years ago and haven’t done anything sense).

Constant Investment Balance Account - The value of your account swings from 18% above to invested amount in February to 18% below the invested amount in March… but by June you are back to an 11% gain.

So your account value went from +18% to +11% in a few months? Who cares, right? You aren’t even planning to use this money for 20 years.

How does this look when you are actively adding funds (increasing balance) throughout the downturn? Worse!

Increasing Investment Balance Account - The value of your account swings from 15% above to invested amount in February, to 21% below the invested amount in March… but by June you are back to a 9% gain.

Why did the account where I’m adding money (approximately) every two weeks perform “worse” then the constant investment balance account? Howard Marks already told you why - the price you pay matters. I’m oversimplifying here to prove a point, but the reason the first account (constant balance account) outperformed the second account is because the first account invested funds at a better price (which led to better value, on average). The second account invested funds like clockwork at higher average prices and that ultimately hurt returns (it would be the opposite of the majority of my funds were invested during a period of undervaluation). That said, the second approach (investing at regular intervals has been recommended by me, and people smarter than me, many times) is a great approach for your average retirement or long-term savings account.

The key points here are:

Changing your perspective (often by shifting to a longer-term point of view) can make an unforgettable market crash feel like “nothing” in retrospect; and

The price you pay matters. Almost anything can be a good investment “for a price”

One additional note… I’m not saying all market downturns are “nothing” and you should expect to always have most of your money back a few months after a significant downturn (quite the opposite, in fact). I’m saying looking at investing performance over longer periods of time, without the feelings of panic and loss often reframe the story. In my opinion, one should be concerned about the current value of US stocks… because their valuations are near all-time highs. Depending on your situation that might not be the “for a price” that is right for you.

Happy 4th!

Coming in Q4: How to design compensation plans that are win-win and how designing them appropriately can increase engagement, retention, and profitability.