All business owners are struggling to create the ideal way to retain their top performers. As a CFO, it pains me to see companies try to “show their employees the love” and miss the mark. The perfect compensation plan varies by employee, but there are common mistakes that are easily fixed by the framework described below. Like it or not, your incentive plan becomes part of your company’s identity, and your employees will behave rationally based on the incentives that are provided to them.

““Show me the incentive and I will show you the outcome””

After many years of obsessing over this problem, I’ve finally found a framework that works for the large majority of companies and employees… and that is a big deal because if you get this right, your company will be more profitable, your employees will be more engaged, and your stress levels will be reduced.

I believe the structure outlined below is the best way to create incentives for your employees which will lead to improved retention and growth. However, the structure only works if your business is profitable and built on a solid foundation (if you have problems there, I can fix them).

First, let’s fix two common compensation problems. Don’t provide all your pay adjustments at one point in the calendar year. The hedonic treadmill created by the human brain is a challenge for everyone, don’t group three separate events (annual raise, bonus, and profit sharing) into one event just because it’s easier on your finance team. Doing so makes your employees feel really good for about three weeks and then underwhelmed by their compensation for the other 49. Second, understand that the financial information can’t always be an open book. Many resources suggest incentive plans based on entirely open books, like Profit Works by Alex Freytag and Tom Bouwer. That is a deal breaker for the majority of SMBs in this country, often because the owner’s personal finances are strongly entangled with the business’ finances. Too much transparency leads to one of two reactions: “I’m getting fired” (in bad times) or “I’m getting screwed” (in good times). Those reactions are understandable, it’s likely that less than 1% of your employees have ever managed the finances of a business this size (they don’t understand taxes, recessions, clients not paying their bills, overstaffing, having personal debt backing the business, etc.). It’s almost not fair to expect them to interpret the business finances correctly… most businesses shouldn’t do it.

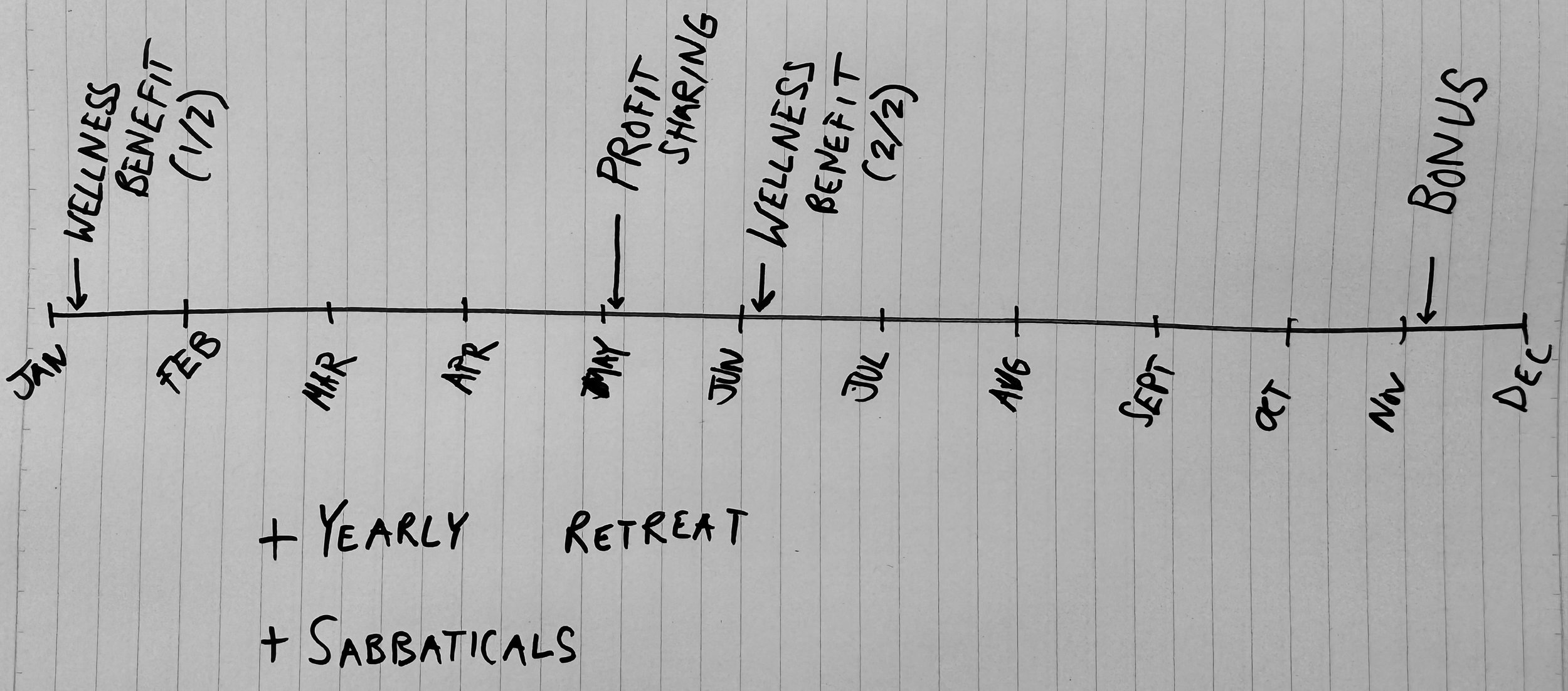

The ideal compensation plan includes four or five times each year where your employees get extra compensation, to consistently show your appreciation for their hard work. The timeline above is hand-drawn by design, this is the hundredth iteration...

So, back to the ideal incentive plan. It should look something like this:

Fair Salaries

Wellness Benefits

Regular Pay Increases

Annual Bonuses

True Profit Sharing

Yearly Retreats

Sabbaticals

This structure provides a thoughtful solution to employees who value different incentives. Three of the six incentives aren’t directly tied to cash. A wellness benefit provides funds to grab a gym membership, retreats allow for times to build in-person connections, and sabbaticals allow your team to unplug from the job and recharge (an example sabbatical structure might allow for a five-week sabbatical after five years of employment and would cost your company about 1.5% of revenue).

The direct monetary benefits allow your employees to keep up with increasing costs (regular pay increases), share the company’s wins (true profit sharing, sharing a % of net income after-tax), and bonuses (a portion of pay that is saved by the company to make your staff feel loved at the appropriate time of year).

Lastly, you should plan the timing of those benefits in a way that makes it clear that you love and appreciate their work year-round (this will vary by company but likely will look something like the sketch above).